Tendering? Keep your Audited Accounts on track

These present an independent opinion on your financial statements & helps procuring entities be sure of your business’ financial standing.

Once a business entity is registered by the Business Registrar Services, they are expected to engage the services of the certified auditor in developing their annual financial report. When it comes to tendering, the purpose of the audited accounts is to present an independent opinion on the financial statements of your business and helps outside parties (such as procuring entities) to be sure of the financial standing of your business.

Audited financial statements as a legal requirement

When creating a checklist for the mandatory requirements for a tender, it is not uncommon to come across a line similar to this:

Provide Audited accounts for 3 years (2017, 2018 and 2019) signed by certified accountants. Firms with audited accounts for the Financial Year 2020 will also be considered. The accounts must provide the certified accountants practising number.

Basically, the auditors are expected to establish whether financial statements are presented in accordance with accepted accounting principles. This is a one-off annual process that’s done at the end of the calendar year and the statements provided are valid for as long as required (hence the variations in the number of years requested in each RFP).

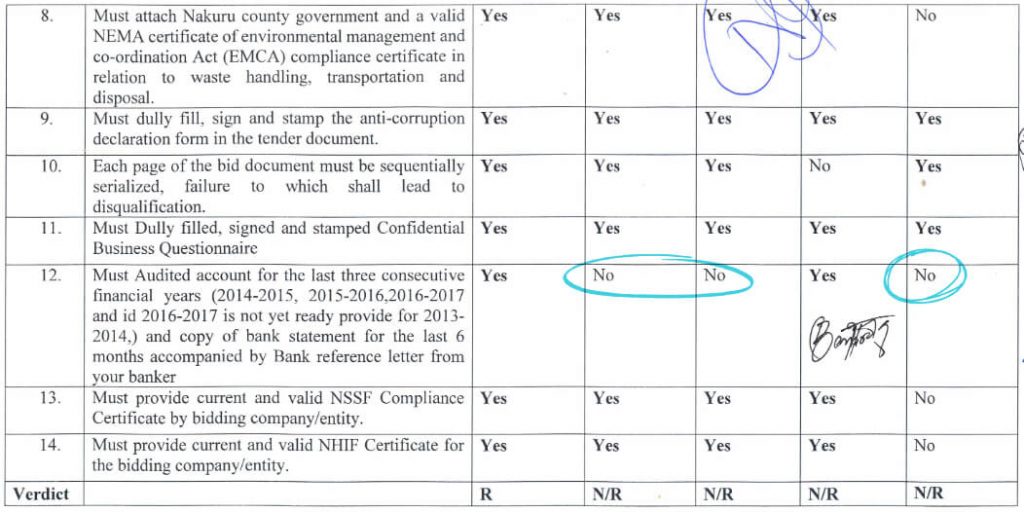

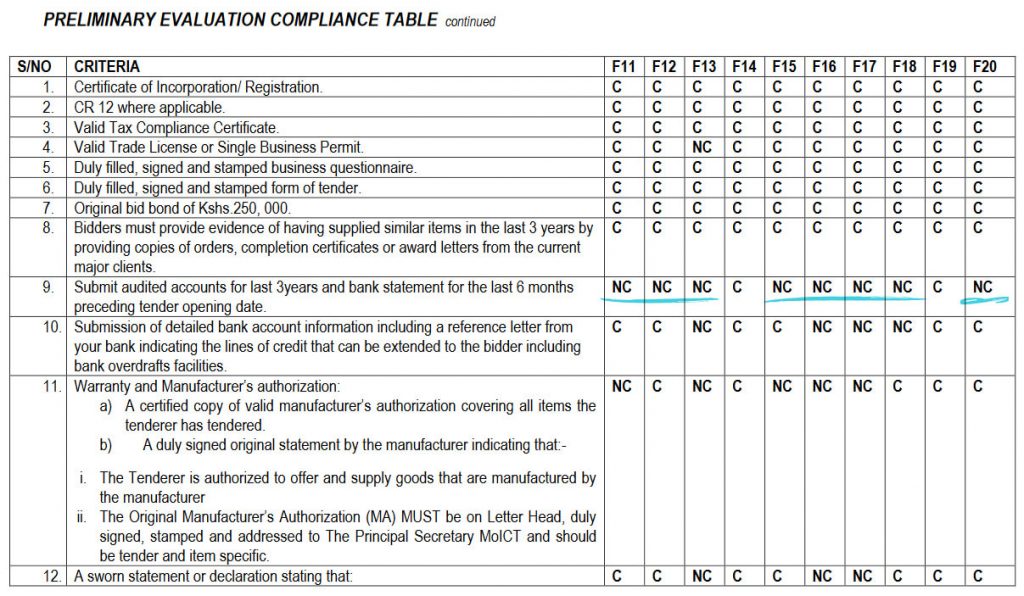

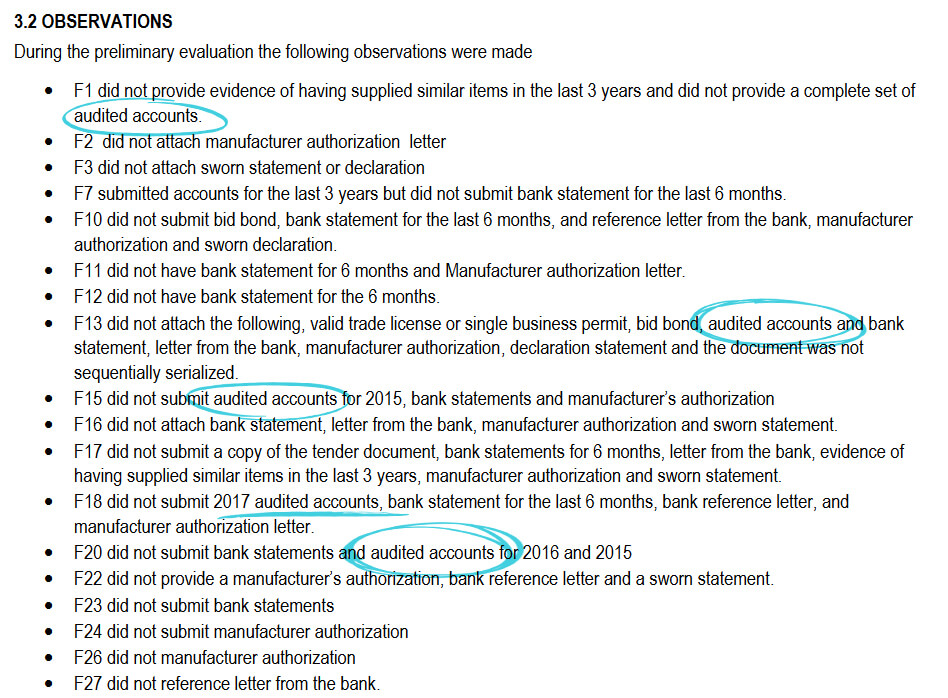

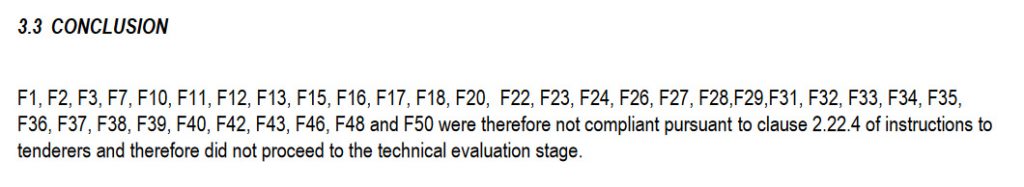

Going through a number of government Tender Evaluation reports, we were able to establish the examples of some businesses that submitted their tender proposals without attaching the required number of audited accounts.

This shows a good number of them getting evaluated as being Non-Compliant (NC) to the tender requirements:

Below is the detailed explanation of those that were marked as ‘NC’ in the above to indicate ‘Non-Compliance’:

As seen, the bidders lost out on crucial points because they failed to attach the requested number (as well as years) of audited financial statements.

A lot has changed since the Access to Government Procurement Programme came into place. Traditionally, this has been one of the main requirements that locked out youthful businesses from accessing government tenders. For AGPO specific tenders, the requirements can, at times be eased, by not making Audited Accounts mandatory – but this does not mean that the document has become less important for any business that’s serious enough about winning more tenders.

Not just for points, your proposal also gets to stand out!

Whether you are bidding for a government tender or a private sector tender, you definitely want to do everything in your power to win it. This means that you have to ensure you have all the necessary documentation that is requested for.

Having your financial audit documents ready through an independent party can make your bid more compelling and improve your chances of winning the tender by:

- Makes your proposal more competitive – Having audited financial statements sets your tender submission apart from the others by giving the procuring entity increased confidence that your financial information is sound and accurate.

- Show of transparency – The procuring entity that is reviewing your proposal can have confidence as your financial statements will have been looked at and tested by an independent (and certified) person as part of the audit. This could also act as proof of your ability to be accountable through the project.

- An accurate view of financial standing – Undertaking a financial audit through a certified account provides an independent overview of how your business is performing. Further, it shows the government agency or private sector entity to whom you’re applying that your financial information is unbiased and true.

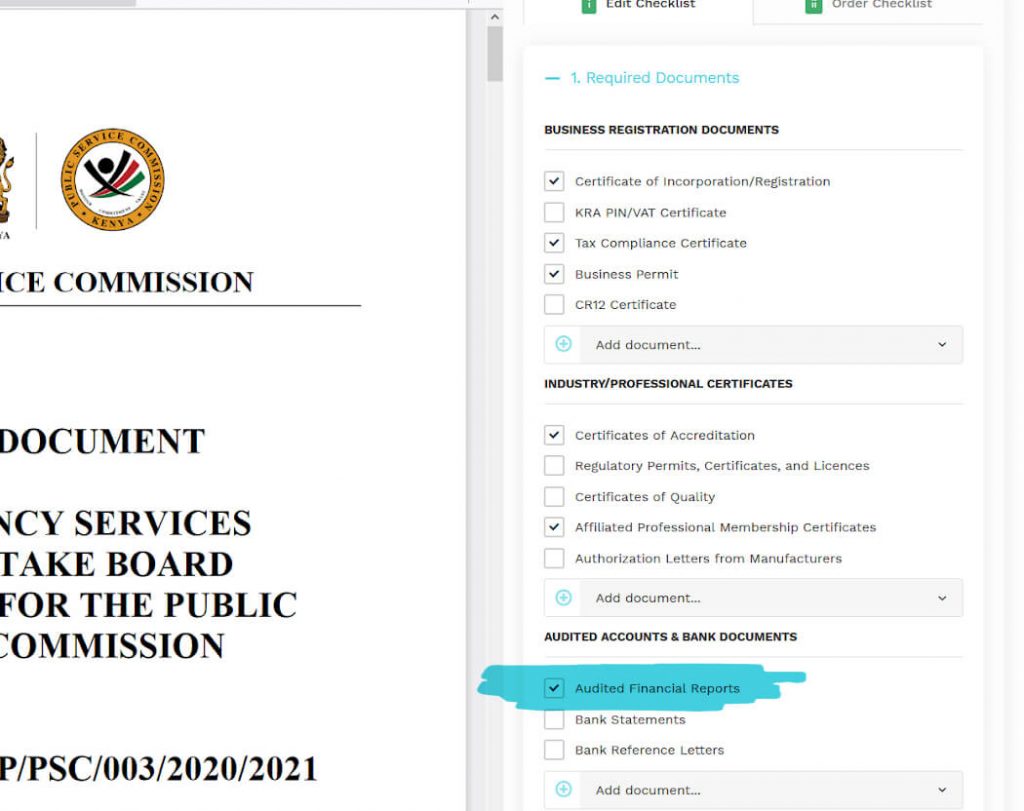

Keeping track all your Audited Accounts and Bank Statements

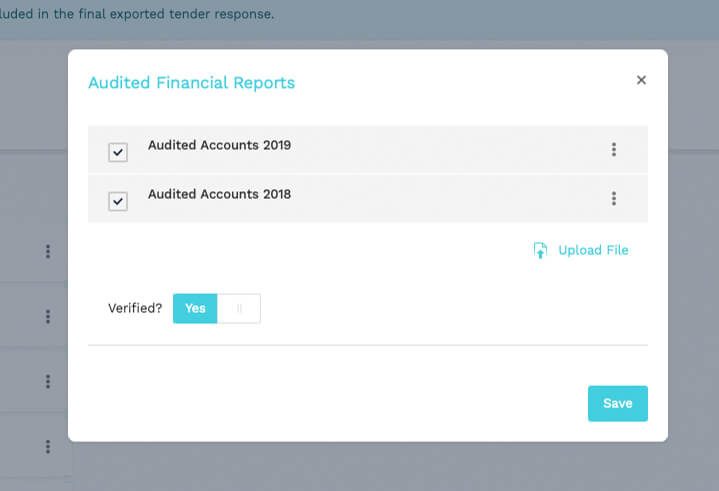

At the core of Scale’s system is the ability for users to organize and securely store all their important business documents needed for any tender application. This includes a specific section for handling Audited Accounts and Bank Statements as shown below:

Once accurately stored and named according to the year of the audit, your document will then be accessible to you during any tender application that you are working on. All you will need to do is to choose which particular Audited Account Statement to add to your proposal.

This ensures that you always do two things:

- You always have access to the true and accurate copy of the Audited Accounts that you need to use in your proposals.

- You do not forget to include the requested documents each time you are working on any tender response.

Get started for FREE with scale.co.ke today and start winning more tenders by transforming how your business finds opportunities and prepares tender responses.

…This article is part of the Common Tendering Mistakes blog series.