What is eTIMS — And Why It Matters to Every Kenyan Business

The Kenya Revenue Authority (KRA) introduced a major shift in how businesses issue and report invoices: the Electronic Tax Invoice Management System, commonly known as eTIMS. If you’ve heard about it but still aren’t sure what it means for your business, this post will break it down simply and clearly.

The Kenya Revenue Authority (KRA) introduced a major shift in how businesses issue and report invoices: the Electronic Tax Invoice Management System, commonly known as eTIMS.

If you’ve heard about it but still aren’t sure what it means for your business, this post will break it down simply and clearly.

So, What Exactly Is eTIMS?

eTIMS is KRA’s digital platform for real-time invoice validation. Every invoice generated by a registered taxpayer must now be electronically signed and submitted to KRA’s system. Once submitted, the invoice is given a unique control number (similar to a digital stamp of approval), making it officially tax compliant.

Why Did KRA Introduce It? To:

- 📊 Improve VAT collection

- 💡 Reduce tax fraud

- 🔍 Make audits faster and more accurate

- 📈 Increase transparency between businesses and the tax authority

What Happens If You Don’t Use eTIMS?

If your business fails to comply:

- Your invoices may be considered invalid

- Buyers may refuse to pay or won’t be able to claim VAT

- You risk penalties and audits from KRA

For businesses that depend on steady cash flow, the risk isn’t just legal — it’s financial.

Who Needs to Use eTIMS?

Every VAT-registered business in Kenya.

And soon, even non-VAT registered entities may need to comply, especially when transacting with large buyers who insist on eTIMS invoices to meet their own compliance obligations.

What You’ll Need to Be Compliant:

- A valid KRA PIN

- Access to an eTIMS-approved invoicing tool (like Scale)

- Internet access (for real-time submission)

- The ability to generate invoices with required fields, such as buyer details, VAT breakdown, item codes, etc.

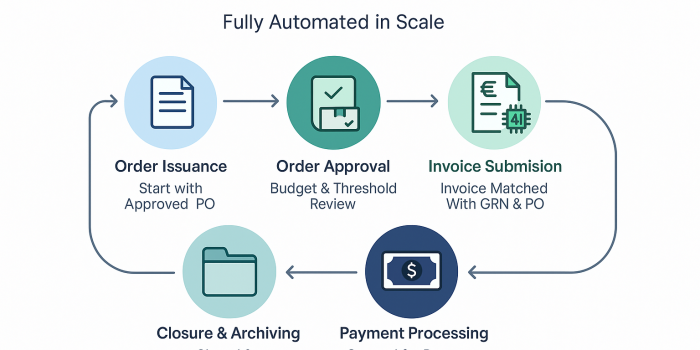

How Scale Helps (Coming Soon)

Coming soon:

- You can create quotes, convert them to compliant invoices, and submit to KRA all in one place, No extra software.

- No need to learn how eTIMS works behind the scenes

- Whether you win jobs on Scale or outside it, you can stay compliant with just a few clicks.

It’s here…

eTIMS isn’t coming — it’s already here.

If you haven’t adjusted yet, now is the time to act. But with tools like Scale, you don’t need to panic. You just need to plug in.

Stay compliant. Get paid faster. Grow with confidence..